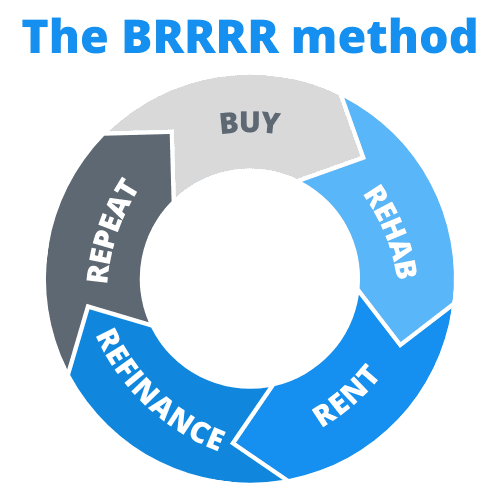

Breaking down the BRRRR method

When you buy a property, fix it up, improve its value, and then refinance, you’re borrowing against the value of the property at its highest. Done correctly, this allows you to recover more of—or sometimes all of—the money you invested in the property.

Here’s what you need to know.

1. Buy

They say you make your money when you buy, and that’s definitely true. But to paraphrase Tolstoy’s opening line of Anna Karenina, all good deals involve a good purchase, but each bad deal is bad in its own way.

Most lenders will finance 75% of a property’s value, so holders should aim for 75% all-in. And they generally do— because they have some money they can leave in the deals and are prioritizing volume. If that doesn’t describe you, I would argue you should stick with the 70% guideline for two reasons.

- Refinancing costs money. Most banks charge a point, and there will be an appraisal, title work, and loan processing fees that eat away at your margin.

- Aiming for 75% offers no contingency. People go over budget more often than under budget, so building in a bit more of a margin is a better idea unless you are going for volume.

Several options can help you purchase a rental property, such as cash, a hard money loan, seller financing, or a private loan. Deciding which upfront financing to use is outside this article’s scope, but what’s important to note here is that different upfront financing options will result in different acquisition and holding costs. You need to account for those when analyzing a deal to hit your 70% or 75% goal.

So what’s the key to BRRRR success? Buying properties under market value and never investing more than 75% of the property’s after-repair value (ARV). This ensures you never run out of capital and can continue buying forever.

Let’s start with your ARV. I recommend having a trusted source like an experienced agent, lender, or other investor give you a conservative number they believe the house will appraise for once it’s been repaired the way you intend. Take that number and multiply it by .75. This is your “target.” Your goal is to get the rehab and the purchase price to add up to this target goal.

If you pay too much for a property, there is very little you can do to recover from surprises and problems.

2. Rehab

There are two key questions to keep in mind when rehabbing a rental.

- What do I need to do to make this house livable and functional?

- What rehab decisions can I make that will add more value than their cost?

If you rehab correctly and make sure you add value when you do, you are pretty much guaranteed to recover your money—and then some. However, unless you buy and hold luxury rentals, generally speaking, these things aren’t necessary:

- Granite countertops

- Brazilian hardwood floors

- High-end stainless steel appliances

- Bay windows

- Skylights

- Hot tubs

- Chandeliers

It’s also rarely worth finishing a basement or a garage for a rental. Instead, consider changes like two-tone paint, refinished hardwoods, and new tile.

And, of course, the house needs to be in good shape. Everything needs to be functional. Being a slumlord will hurt you in the long run—and the industry’s reputation.

Of course, your new investment won’t be in good shape when you purchase it. That’s the point! I intentionally look for properties that need massive repairs because I know other investors will ignore them and the sellers will be more motivated to drop their prices.

Some of the best problems to look for are:

- Roofs. If you add a new roof, appraisers tend to give you back the money you spent in property value.

- Unfinished kitchens. An outdated kitchen is ugly but still usable. A partially demo’ed kitchen makes a house ineligible for financing and, therefore, much easier to buy with cash.

- Drywall damage. Drywall damage makes a property ineligible for financing while also scaring away most home buyers. The good news? Drywall isn’t super expensive to repair.

- Horrific landscaping. Overgrown vegetation frightens the competition but costs very little to repair. You don’t need a skilled landscaper to hack down overgrown landscaping, so a few hundred dollars will take you farther than you think.

- Outdated bathrooms. I routinely completely remodel bathrooms for $3,000 to $5,000. Most bathrooms aren’t huge, so the material and labor costs come in low. This allows your house to compare to much nicer homes in the neighborhood with higher ARVs.

- Too few bedrooms. Homes with more than 1,200 square feet but less than three bedrooms offer easy ways to add value. Adding a third or fourth bedroom helps it compare to much more expensive properties, increasing your ARV.

By targeting properties like these and making repairs at below market value, you can add big equity to your deals.

3. Rent

Banks rarely want to refinance a property that isn’t occupied, so renting your house comes first. It’s critical to screen diligently so you get tenants that will pay each month. But it’s also important on the financing side. While appraisers shouldn’t put too much value on how clean and pleasant the tenant is, everyone is human. First impressions make a difference.

You need to notify the tenant before an appraisal. I always recommend you request interior appraisals versus drive-bys: Appraisers are more cautious and may downgrade your property unfairly with drive-bys. Send out or post a note on your tenant’s door about the date and time and give a reminder call the day before, unless your local laws require something else. Tenants don’t need to be present, but you should ask them to clean up and kennel any pets if they aren’t home.

One thing to keep in mind with the BRRRR strategy: Your mortgage will typically be slightly higher than with the traditional method because you are borrowing more money against the house. This is well worth it. Capital in the bank can be used to grow wealth, while you can’t use the equity in a property for much. The flip side of this argument is that your cash flow will be slightly lower with the higher mortgage payment.

This means you have to be that much more careful when running rental comps to know what you can expect for rent once you purchase your property.

4. Refinance

Not too long ago, it was tough to find a bank that was willing to refinance single-family rental properties. Now it’s much easier. Still, when looking for such banks, there are a few things that you will need to ask.

- Do they offer cash out, or will they only pay off debt? If they don’t offer cash out, move on.

- What seasoning period do they require? A “seasoning period” is how long you have to own a property before the bank lends on the appraised value instead of how much you’ve invested. For the BRRRR strategy to work, you must borrow on the appraised value. These days, some banks are willing to lend on the appraised value as soon as a property has been rehabbed and rented. These are the best banks to find.

To find great BRRRR banks, ask around. Ask investors you know, or query the BiggerPockets Forums users. A bank already lending to another investor will likely lend to you, too.

Here’s another unique way to find banks to help you refinance your property. Go to a website such as ListSource or CoreLogic and search for every loan made in your city and price range in the last year to non-owner occupants. This search will probably cost a couple hundred dollars.

Right off the bat, you know these banks lend to investors at the price point you require. They’ve done it before, so there is a good chance they will do it again.

Provide the lender with thorough, clear information. This impresses them—remember, these are human beings, not computers—and helps them decide quickly.

The trick to being successful here is getting as high an appraised value as you possibly can. A big part of success in this area is a combination of how well you rehabbed your property and how strong your initial comps were.

Sinking a lot of capital into a deal and then failing to pull it out is a big problem. I recommend getting pre-approved for a loan before buying.

5. Repeat

The “repeat” part of the BRRRR cycle is the most fun. Take everything you learned, gained, and improved upon and put it back into action.

Work on building systems, too. Systems help you accomplish your objectives by repeating the same process over and over. Systems cut down on mistakes and stress. The more documented your systems are, the less you’ll worry about something being missed, overseen, or forgotten about.

Comments are closed